Thesis summary

CarMax is a high-quality business with customer-centric service and a modest but developing economic moat. It operates in an industry that is moderately cyclical. CarMax could be a long-term winner if it keeps optimizing its service, and almost nothing could prevent it from steadily gaining market share from those much smaller and even mom-and-pops dealerships. This reminds me of the funeral home company Service Corporation International (SCI) which experienced a similar process last century.

The basic narrative remains unchanged notwithstanding, today the stock trades at half of its all-time highs. Now it became an undervalued stalwart in that it is faced with strong industrial headwinds and investors are fearful of economic uncertainty (a potential recession ahead? Who knows). Such investor sentiment presents us an opportunity to buy a fantastic company that could grow its top lines ~10% annually at a relatively low price.

My conservative valuation method suggests that buying now at $78.42 could yield an estimated 3-year IRR of 16.7%. Even in the base case, there would still be a moderate capital gain if the industrial conditions normalize. Chances are low that CarMax’s business is impaired permanently, or the service quality experienced a rapid deterioration. Instead of taking CarMax as an industry turnaround play, I would prefer a much longer holding period, compounding my investment in this great company. Trimming at exuberance and doubling down at troughs might be a good strategy that brings 15%-20% long-term annualized return on the stock.

Price: $78.42

Market Cap: $12.41B

EPS (Forward): $3.05

P/E (Forward): 25.76

P/FCF: /

Aug 29, 2023

Introduction

I’ve come across discussions about CarMax in Value Investor Insight several times, sparking my interest in researching the automotive retail and auto parts retail sectors. Although on the surface, auto and auto parts retailing appears to be a highly competitive industry with participants struggling to establish a deep moat, it has produced several compounders, such as O’Reilly Automotive (ORLY), AutoZone (AZO), Lithia Motors (LAD), and CarMax (KMX). In the past year, CarMax has faced strong headwinds (remember, we were not born in the age of sail), and the near-term outlook is mixed at best, with significant uncertainty ahead.

The time when trend/outlook investors panicked could be a boon for value investors who try to find bargains. I believe the headwinds presents an opportunity for long-term value investors to acquire a long-term compounder at a reasonable price. I made my first buy recommendation elsewhere on Mar 15, 2023 (unfortunately, this website was only launched in August), when CarMax was still struggling, with its stock trading at $59.13. Over five months have passed, and the stock has rebounded to $78.42, but I believe there is still a decent long-term upside to buying now, with limited downside.

I would not make economic predictions (more specifically, on interest rate, used car prices, industry timing in this case). However, when the conditions are really bad, the risk/reward will be tilted in your favor (of course you should make sure that the company is well-positioned and is able to ride out the ebbs and flows). This is why Sir John Templeton said that “the time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” If the used car retail industry continues to deteriorate in the future, but the long-term story remains fundamentally unchanged, I will consider buying more.

Background

Company: CarMax, Inc., together with its subsidiaries, operates as the largest retailer of used vehicles in the United States. It operates in two segments, CarMax Sales Operations (Retail and Wholesale) and CarMax Auto Finance. The company offers customers a range of makes and models of used vehicles, including domestic, imported, and luxury vehicles, as well as hybrid and electric vehicles. The company has been constantly aspiring to become the most customer‐centric omni‐channel experience in the industry. They were named by Fortune magazine as one of its 100 Best Companies to Work For® for the nineteenth year in a row.

CarMax typically focuses on 0-10 years old vehicles that cost between $14,000 to $47,000. For the older vehicles acquired by KMX, they are typically sold through its wholesale auctions. In fact, the company holds the distinction of being the largest wholesale used car auctioneer in the United States. These vehicles typically fall into the category of being 10 years old or older and having accumulated over 100,000 miles.

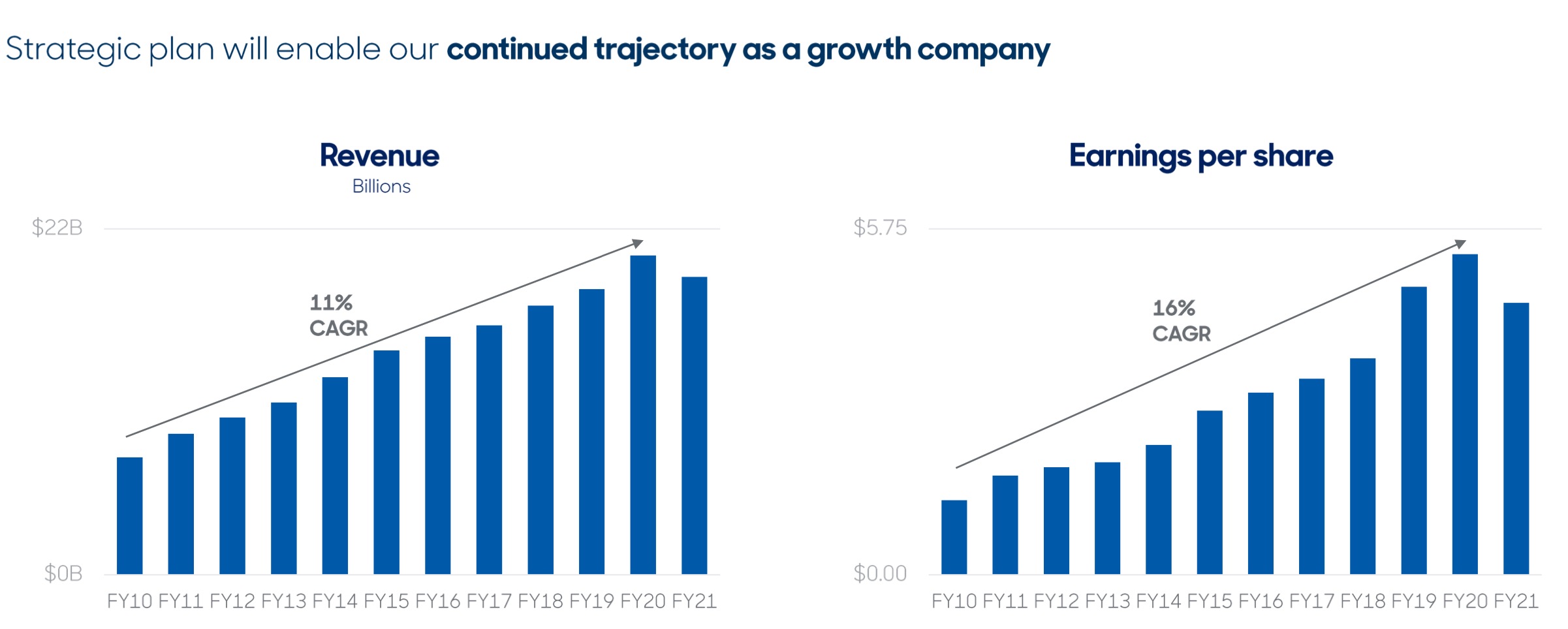

Before the abnormal industry dynamics caused by COVID, CarMax achieved 11% CAGR on revenue and 16% CAGR on EPS. The growth path is quite steady until interrupted by the ebbs and flows of recent market anomaly. Even though CarMax is faced with short-term headwinds, there is, in my opinion, almost nothing prevents it from gaining more and more market share from mom-and-pop dealerships and those adjust slowly to the e-commerce trend. In the long-term, CarMax is well-positioned to attain 5%, 8%, 10% market share. The runway is still long.

Source: CarMax 2021 Analyst Day

Source: CarMax 2021 Analyst Day

Industry: CarMax operates in a highly fragmented and competitive industry, in which CarMax was estimated to capture ~4.0% of the age 0- to 10-year-old vehicles sold on a nationwide basis. The US used car industry is estimated to grow at a CAGR of ~6% by several market research teams. It is a mature business subject to cyclical economic impacts. According to industry sources, there were more than 18000 franchised dealerships in the USA, but there were even much more mom-and-pop independent dealerships. Such an industrial condition may provide several well-positioned far-sighted companies with a great opportunity to steadily growing market share against those with worse customer service, limited financial wherewithal, and much smaller scales. One disruptive factor that must be taken into account is the digital transformation. The online sales channels have the potential to transform the competitive landscape of used car retail business.

What happened: After the outbreak of COVID, the financial stimulus and limited spending alternatives (such as traveling) together contributed to the demand of autos and residential real estates. However, the supply chain problems in semi-conductor sector became prominent, limiting the supply of new cars. As a result, the pent-up demand for autos turns toward the used car industry, pushing up the used car prices to a lofty level. Ominous signs have emerged since the second half of 2021. In 2022, things started to go sourer. In December, CarMax reported disappointing FY2022 Q3 results, largely due to higher interest rates (auto financing became expensive at much higher rates; people with 700+ credit score was offered 9-10% interest rates) and used car affordability (used car prices were too high). Sales were going down, auto finance went hand in hand with declined sales, and the net margins have been deteriorating for a year (from 5.03% to 1.63% in FY2022 Q4).

Mr. Market disliked the significant uncertainty in the used car market in the near term then and held a generally pessimistic view of the economic outlook for 2023. As a result, CarMax’s stock price has plummeted by 64% in less than a year from its all-time high price of $154.85 on November 09, 2021. Many buy-side and sell-side professionals stood on the sidelines, if not jumped right in to short the stock. Short interests were once in the mid-teens.

In 2023, the company reduced its selling prices to clear out inventory (it seems a good precaution of used car price dive), even as it grappled with a challenging business environment. Despite declining top and bottom-line figures, the company saw an improvement in its unit economics. Marketing expenses decreased at a rate much steeper than revenue, suggesting that there was an underlying demand for used cars.

As in previous crisis, the management prioritizes profitability over market share gaining in the uncertain environment:

For context, we have lost the market share during prior down cycles. In those cases, we recovered the market share and then continued to grow up to new heights as economic conditions improved. We remain focused on achieving profitable market share gains that can be sustained for the long term and plan to continue running extensive price elasticity tests.

Source: CarMax FY2023 Q4 Earnings Call

Source: TIKR Terminal

Competitive advantage

It is, generally speaking, not easy for a company to distinguish itself from its competitors in the used car retail industry. The customer loyalty is low, and many buyers are highly price sensitive. The customer satisfaction could be much harder to maintain than new car retail in that used cars have more idiosyncratic risks of breaking down. When a new car has some issues, the customer generally blames the auto manufacturer; when a used car has some issues, the customer almost always blames the auto retailer. Such customer psychology means that service and selection lie at the center of the business. Even though CarMax does not have a Buffett-type moat, it has been meticulously digging (service, selection, omni-channel platform and technology) to protect against erosion.

Service: CarMax make many meaningful measures to streamline its service and customer experience, such as non-haggle prices sales process. It also stands out because of its cutting-edge service centers, where qualified experts work, furnished with the most recent equipment. I will not elaborate on this. What really pikes my interest is the incentive plan for the sale consultants, which significantly reduced the possibility that the sale consultants sell their customers inappropriate cars out of self-interest:

Customers may also interact in-person with our sales consultants who are generally paid commissions on a fixed dollars-per-unit standard, thereby earning the same commission regardless of the vehicle being sold, the amount a customer finances or the related interest rate. These pay structures align our associates’ interests with those of our customers, in contrast to other dealerships where sales and finance personnel may receive higher commissions for negotiating higher prices and interest rates, or steering customers to vehicles with higher gross profits.

Source: CarMax FY2022 10-k

An incentive plan like this is suboptimal for the short-term benefits of the company but is beneficial for the long-term success. A detail like this definitely shows that CarMax “cares” about their customers.

Selection: CarMax has achieved the largest scale in the industry. It has an edge in inventory management, and thus it can offer a significant more diverse selection. This edge could even be enlarged with the company gains larger market share as time goes by. What’s more, they reconditioned the used cars to meet their internally developed CarMax Certified Quality Standards. But when I checked the customer reviews and litigations, I realized that there could be some idiosyncratic issues with some cars sold in retail channel. For its competitor AutoNation, the issue is even worse. I suspect that this is a problem faced by the whole industry.

Omni-channel presence: Omni-channel presence provides clients with a smoother consumption experience. Since online dealerships are considered by industry gurus to be a disruptive force to the traditional brick-and-mortar dealerships, CarMax recognized this and heavily invested in the omni-channel presence as well as technology to expand the addressable market and streamline customer service. With our core omni capabilities now in place, CarMax is then continuing to prioritize projects that drive operating efficiencies and optimize experience for our associates and customers. From my perspective, the company has made satisfactory progress so far in omni-channel platform, which will further deepen the moat and position the company better for the future than many other traditional dealerships that are slow to adjust themselves to changes. Compared with purely online used auto dealerships, CarMax has competitive edges in that it has a large-scale well-established physical business that fuels the development of digital transformation. The purely online competitors, either failed to achieve a good scale at a relatively fast clip or failed to achieve profitability. Just think about Carvana (CVNA) and Vroom (VRM). There are many cases when the first movers died first, with many arrows in the back. CarMax could be the best positioned for digital presence if industry turmoil persists. It is probable that the network effect brought about by digital presence would in turn benefit the physical business, because still many buyers prefer to have a test drive or something before they make their purchasing decision.

Technology: Despite encountering tough short-term sales growth conditions, CarMax seems to be on the right track to make long-term investments in technologies. The company is using data science, automation, and artificial intelligence to streamline critical customer transaction processes. Due to my lack of knowledge, I don’t believe I can evaluate the effectiveness on these investments. But today’s investments may bear fruit tomorrow.

Financials

ROIC and leverage: CarMax screens terribly on the surface mainly because of 1) low long-term ROIC 2) high leverage. The ROIC in the past decade (excl. data after COVID) was constantly lower than 6%, and now ROIC has decreased to an unacceptable level. The total debt/equity was once 422.8%, which went slightly down to 340.6% in FY2023. Without digging deeper, some investors might consider this to be a long-term value destroyer that takes on too much debt. However, the abnormal results were due to an accounting change that requires CarMax to put “non-recourse debt” on the liability side and an offsetting “loan receivable” on the asset side. The essence of business changed nothing, whereas the numbers changed a lot. Most of the total debt shown on the data terminal is “non-recourse debt”.

CarMax’s economic exposure to these notes is far less than what is listed on the balance sheet, and it should not be considered CarMax debt for two reasons:

1) CarMax is not required to pay the interest on these notes.

2) CarMax cannot lose control of its business given the non-recourse nature of the notes.

Source: seeking alpha

With the “non-recourse debt” taken out from the balance sheet, the normalized ROIC before COVID ranges from ~12% to 16%, with an average of 14.6%. Even though this figure is not ideal for some quality investors, it is significantly higher than the capital cost of both equity and debt. With an appropriate level of leverage, the normalized ROE trends around 20% (from 2010 to 2020). The level of normalized ROIC and ROE is at least not bad for companies in a capital-intensive industry without much pricing power. As for leverage, the management targeted adjusted debt-to-capital leverage ratio at a range of 35%-45%, which I think is reasonable for a used car retailer. The good news is that now the adjusted debt-to-capital leverage ratio is even lower than the lower limit of the target range. This provides the company with a financial margin of safety to weather a bad business environment that lasts longer than expected.

High COGS relative to gross profit: The high SG&A became a major concern of CarMax shareholders and management as well, largely due to the increased tech spending overheads. Since used car retail is a capital-intensive low-margin business, the near-term earnings were hurt by the percentage of SG&A relative to revenue. The management attempted to improve on SG&A by 1) lowering compensation and benefits 2) reducing advertising to a level that on a per unit basis was aligned with that of the second half of 2022 3) cutting overhead. They also claimed to focus on gaining efficiencies. Those measures are reasonable in an uncertain business environment.

SG&A remained an issue as of 2024 Q1:

SG&A as a percent of gross profit was 68%. Excluding the benefit from the settlement, our SG&A leverage was 76%, roughly flat to last year’s first quarter. The change in SG&A dollars over last year was mainly due to the following factors.

Source: 2024 Q1 Earnings Call

In FY 2024, they expect to require low-single-digit gross profit growth to lever SG&A, well below the levels that we indicated during the investment period of our omni transformation. 3-5 years out, once the used car market normalizes, SG&A will no longer be an issue anymore.

Management

To make sure that the management’s interest is aligned with the shareholders, incentives and operation history are among the most important that we should pay careful attention: whether the management has been appropriately incentivized; whether the management ever overpromises and underdelivers; whether the management has the long-term mentality that is conducive to the future prosperity of the business.

Compensation plan: Charlie Munger famously said: “Show me the incentive, and I’ll show you the outcome.” I am satisfactory with the compensation plan overall, even though the compensation plan is not ideal from my perspective. For example, the long-term performance stock units are granted based on pre-tax EPS performance and market share. It may be better if they also include ROIC and CSI metric (customer service index) as granting measures for PSUs (Performance Stock Units).

Operation: Bill Nash has been the president and CEO of CarMax since 2016. He pays careful attention to the long-term value creation and service optimization. In the current challenging industrial environment, he appears adaptive enough to headwinds. So far so good.

Capital allocation

The company allocates its capital mainly through capex, share buyback and acquisition. ~80% of annual capex is allocated towards growth with the remainder for the maintenance.

Capex: With a long runway ahead, CarMax is expected to keep allocate a great deal of capex into growth opportunities to gain market share, invest in technologies and omni-channel. Since I believe that the business is scalable, I assume that capital can be reinvested with a normalized marginal ROIC of 12%-16%. Boosted with a proper amount of debt, CarMax could be a multi-year compounder from here.

Buyback: The company made an enormous amount of buyback between 2014 and 2020. I think this is rather wise capital allocation strategy, because they were not like those who make larger buyback in the exuberant period. One of the possible reasons why the company made a massive buyback, apart from returning capital to shareholders, is that half of the management PSUs granting is based on pre-tax EPS. Recently the management prioritized to fund the business due to the adverse industrial and economic environment. When the industry starts to normalize and the economy turns better, it is highly likely that the company resumes its share buyback (at favorable multiples), which will boost stock performance.

Acquisition: The company only made 1 acquisition in the past 5 years: Edmunds Holding Company, one of the most well established and trusted online guides for automotive information and a recognized leader in digital car shopping innovations. I hold the opinion that the acquisition of Edmunds is conducive to CarMax’s omni-channel strategy, but there isn’t enough information to judge whether CarMax paid a reasonable price.

Source: CarMax 2021 Analyst Day

Amateur’s edge (opt.)

I use scuttlebutt method to investigate a group (sample size<10) of CarMax customers and employees. The most precious insight I got about the business is (I mentioned this before in the competitive advantage part): the customer satisfaction could be much harder to maintain than new car retail in that used cars have more idiosyncratic risks of breaking down. When a new car has some issues, the customer generally blames the auto manufacturer; when a used car has some issues, the customer almost always blames the auto retailer. I heard some complaint about miscommunications and poor customer service team.

At first, I was disturbed by this phenomenon, which appears to contradict the claimed service-central focus. However, when I dig deep into its competitors’ customer reviews, I found quite similar issues. Its competitor AutoNation seems to have a worse fame. What’s more, customer satisfaction has become lower since 2021 for the whole used car retail industry. I suppose that lower satisfaction has something to do with much higher used car prices.

Though it is hard to ensure quality every time and make every customer happy, it will be fruitful to commit a lot to what they could deliver to customers. The rapid deterioration in service quality could be a warning sign if industry-average service remains at a similar level.

Valuation

I will make as least as possible assumptions, and then assign reasonable earnings multiples to value the company.

The management expects to capture 5.0% of market share in FY2025 and attain revenue level of ~$33b in FY2026. This is rather consistent with the business trend before the COVID anomaly, and thus it is not unreasonable if the industrial conditions normalize. Assume that the company make $33b in FY2026 with a normalized net income margin of 4.0%; the company has a terminal PE ratio of 15 (lower than the long-term average) in FY 2026; the share counts remain at current levels, the estimated share price in 2026 will be $124.5. This implies a 16.7% three-year annualized IRR. The terminal PE of 15 is rather conservative for a great company that has the potential to grow its revenue at 10% CAGR.

But I would recommend a much longer holding period, since CarMax can be a long-term compounder. Trim when industry and economy prosper and double down when the headwinds are raging. It is possible to have a 15%-20% annualized return on the stock.

What if the reality unfolds beyond our expectations? I assume a base case of depressed $2.4b revenue in FY2026. The company failed to recover to a normalized net income margin of 4.0% (3.0% instead). The investor sentiment is still bad then about the stock, with a terminal PE ratio of 12. Then the estimated share price in 2026 will be $86.4. If this is indeed the base case scenario, investment in CarMax now (if not before) has limited downside. Margin of safety is ensured.

Why this opportunity exists

- The misunderstanding of the accounting nature of “non-recourse notes” which result in low ROIC and high leverage on the surface

- The possibility of US entering a recession

- The industrial headwinds in used car retail industry

- Short-term worries about SG&A

- Concerns about the disruptive forces presented by online dealerships

- The PE ratio appears high at 26.28 (this is because EPS plummeted)

Risks

- Strategic misjudgments

- E-commerce disruption gains larger than expected tractions

- Service quality and fundamental business model deteriorate

Catalysts (opt.)

- Used car retail industry turns better

- The company resumes its share buyback at a favorable valuation

- Omni-channel platform continues to gain momentum

This is perfect!!

The used car prices in the US are just too high for customers. CarMax can’t sell cars:

https://www.youtube.com/watch?v=6h0NBghDv5E

Everyone loves what you guys are usually up too. This type of clever work

and coverage! Keep up the wonderful works guys I’ve included you guys to my personal blogroll.