Thesis summary

Sprouts Farmers Market is a retailer targeting “health enthusiast” and “selective shopper”. They provide foods that are fresh, healthy, organic and life-style friendly. Besides, they also offer some vitamins and beauty products. They try to differentiate themselves from the conventional food retailers. With ~400 stores in 23 states, they still have a long runway ahead of them. They have been rolling out a new store format that can significantly lower expenses and improve operating efficiency, and plan to come back to the track of 10%+ growth, which I think is feasible. The unit economics of opening new stores is spectacular, with a cash-on-cash return of 35%-40%. Their business will continue to see industrial tailwinds for many years to come.

I assume that they can achieve store growth in the low teens, comparable sales growth of 2%, buying back 1%-2% of the shares outstanding per annum. The sales growth in this case will be in the mid-teens. Further assume no margin expansion, The EPS also has an annual growth in the mid-teens. At the current price of $42.39 and forward PE ratio of 15.44x, the PEG ratio will be around 1x. Under the five years investment horizon, if the terminal PE ratio remains at today’s level, the estimated annualized return would also be in the mid-teens. If there are margin expansion and multiple expansion to a certain degree, the five-year annualized return could be 20%. If the business plan unfolds as expected, I will consider a much longer holding period and make it a compounder. But if the story is not as rosy as I imagined, at least the price I paid for a good business is reasonable and the downside will be confined.

Price: $42.39

Market Cap: $12.41B

EPS (Forward): $3.05

P/E (Forward): 15.44

P/FCF: 17.89

Dividend Yield: 0

Oct 08, 2023

Introduction

Many investors think that Sprouts Farmers Market is and will be subject to commoditization and fierce competition, this might be the reason why the stock has a short interest of 20.51%. I once paid two visits to a Sprouts Farmers Market store in California but didn’t quite notice the fact that it is a public company. I am not a “health enthusiast”, so I just failed to see what distinguishes Sprouts from many other food retailers. Later this summer, I tried to dive deep into the U.S. retail industry, and came across the stock. The store chain is well managed; the growth prospects are great; the balance sheet is solid; the institutional investors (oxymorons in Peter Lynch’s parlance) are worried about it. Those are all good signs. I want to mention that in the last 90 days, 14 wall street analysts give their ratings: 9 hold, 3 sell and 2 strong sell. This is fairly rare for a stock that generates a considerable amount of operating cash flows and has accelerated its growth. My guess is, the stock is the baby thrown away by investor community together with the bathwater (Retail apocalypse? Short-term worries about the whole retail industry?).

Source: Seeking Alpha

Background

Company and Business: Arizona based neighborhood grocer Sprouts Farmers Market features an open layout with fresh produce at the heart of the store, reflected in the fact that perishables account for nearly 60% of sales and produce accounts for 20%+. The perishable offering as a whole is a high-frequency and low-margin business, whereas the non-perishable offering brings higher margin. The company operates its stores between a local farmer’s market and grocery chains like Trader Joe’s and Whole Foods. Currently they have ~400 stores, with their operating footprint primarily concentrated in the western United States and Florida. The management believes that their brand can support ~1400 stores in the total Continental U.S., 3.5x the current store count. It is fair to say that with the industry headwinds, Sprouts Farmers Market still has a long way to go.

Source: FY2022 10-k

Targeting what they called “health enthusiast” and “selective shoppers”, they continue to introduce the latest healthy and innovative products made with life-style friendly ingredients such as organic, plant-based, and gluten-free options. The management made a point that till now they’ve only captured a small part of the target customers. As for produce, they strive to provide fresh and unprocessed produce at prices 10-20% (historically 20%-25%) lower than the traditional grocers. Besides, they also offer a wide assortment of vitamins & supplements and beauty products (~13% of total sales). The layout of the old version of store format is illustrated as below:

The old store formats

Source: FY2018 10-k

Different from the conventional food retail store model, Sprouts Farmers Market positions the produce area (~20% of a store’s selling square footage) at the center (essentially at the back, and sometimes in the middle) of the store, surrounded by a specialty grocery offering. This is a smart store layout. Due to the high frequency of produce purchases, it can drive more traffic to other specialty grocery sections. By frequently purchasing the produce, the customers generally explore around, which will boost sales of many other high margin products. In this sense, a low price but high-quality produce offering is the core of the business model.

Industry: The general food industry in the U.S. is slow-growth, counter-cyclical but highly competitive. This is a somewhat commoditized industry, even though many retailers have been promoting their own private brands. The market for foods that satisfy the needs of certain lifestyles, such as vegan and organic food enthusiasts, is much less commoditized and generally grows faster than the market for general foods. Take the U.S. organic food market as an example. According to several market research reports, the U.S. organic food market is expected to grow at a CAGR of 10%+ over the next five years. The increasing societal awareness of healthy diet and governmental support will contribute to the growth.

Source: Precedence Research

Decades ago, when customers had much fewer choices for foods, the key competitive factors are low price and availability. However, now the customers have excessive options to choose from. More and more people are starting to pay attention to some differentiating factors that align with their personal beliefs and lifestyles, leading to the surging demand of organic foods, vegan products, non-GMO foods, etc. This trend constitutes a long-term tailwind for Sprouts Farmers Market.

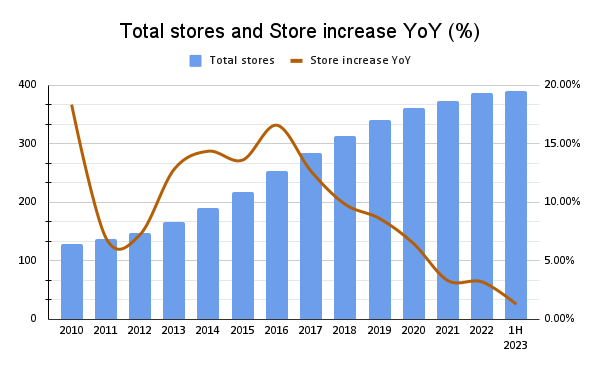

A brief history and strategy review: Sprouts Farmers Market originated in 2002 in Chandler, Arizona, established by the Boney family. In 2011, under Apollo Global Management, Henry’s (43 stores), Sun Harvest (37 stores), and Sprouts (56 stores) merged and were all rebranded as Sprouts stores. The acquisition of Sunflower in 2012 led to its rebranding as Sprouts. The company went public and started trading on NASDAQ in 2013. The store counts more than doubled in the next 6 years, but the share price was cut in half during the same period. If you buy the stock right after the IPO in 2013, you probably wouldn’t break even a decade later.

Source: Tikr Terminal

Source: Seeking Alpha, https://seekingalpha.com/article/4628903-sprouts-farmers-market-new-store-format-will-increase-roic

What happened? Following its IPO at $18 per share, the stock closed at $40+ on the first day of trading, witnessing the exuberant sentiment of Mr. Market. During that period, the management anticipated the business to expand by 14% annually, whereas they underdelivered and fell short of that figure. Even though the company did grow in scale, many investors, especially those growth chasers, started to lose their patience with the stock because the company has seen several changes in leadership and the management took on heavy debt to expand and conduct buybacks. However, the most prominent reason why the stock languishes is the sky-high multiples it had at the very beginning.

Sprouts Farmers Market’s P/E and P/S ratios

Source: Tikr Terminal

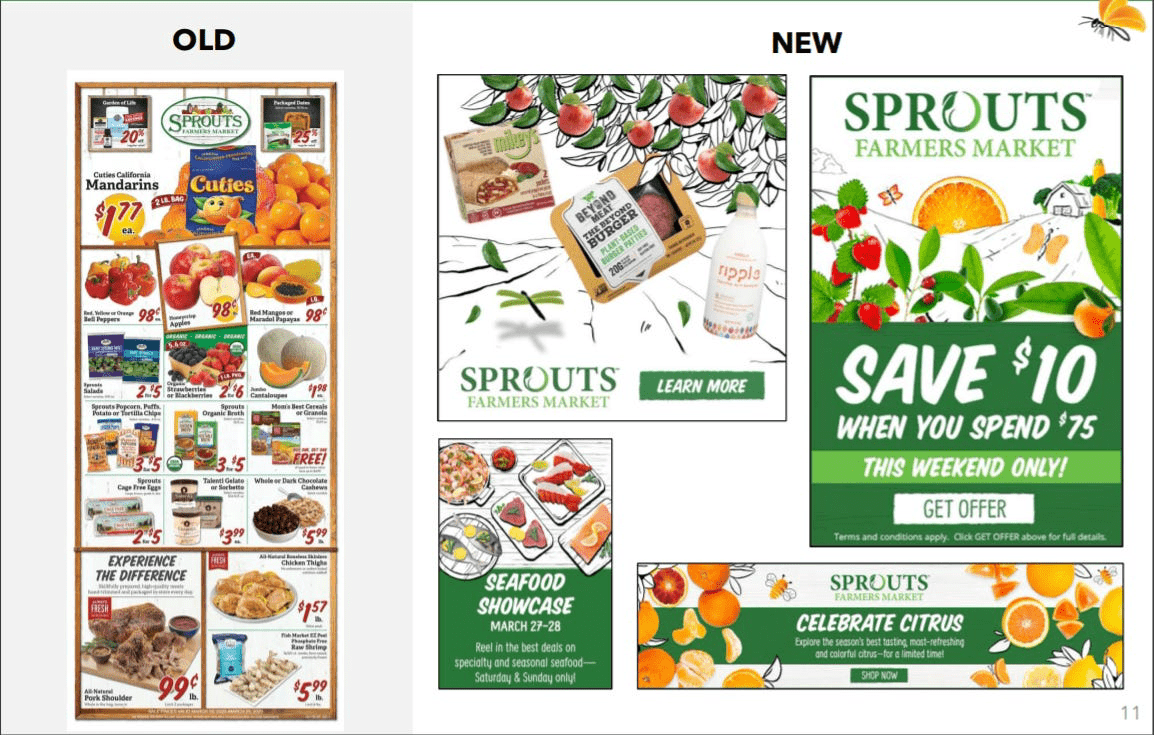

In 2019, Jack Sinclair assumed the CEO position, and later he revised the company strategy: 1) the company has been shifting away from the less effective loss-leader customer acquisition strategy, focused more on ROIC. They have transitioned to a digital-first marketing approach over the physical mailers. This change has significantly improved their marketing outcomes.

Source: Seeking Alpha, https://seekingalpha.com/article/4633323-sprouts-farmers-market-strategic-plan-is-showing-results

2) they are turning to smaller box size (ranging from 21,000 to 25,000 square feet compared with ~30,000 square feet for the old version of prototype) new store formats that minimize non-selling areas, cut down on rents and operating expenses, but provide a quick in-and-out service and a panoramic experience. The new store is more compact and costs 20% less to build than the older one. The early results and customer experience have been good so far.

The new store formats

Source: FY2022 10-k

3) they rolled out their e-commerce capabilities via Instacart, DoorDash and their own shop.sprouts.com. Online sales now account for low teens of the total sales. 4) they keep investing in fresh supply chain, which I believe is the crux of the business. With two new fresh distribution centers opened in 2021, now 85%+of the stores are within 250 miles of a distribution center. They also expand the capacity of the existing distribution centers, paving the way for future growth. 5) they are also dedicated to their private brand, which continues to be a growth driver and has 20%+ penetration in 2023. For private label products, the company has more control over pricing, and they have a higher margin compared with national branded products.

With all those strategic initiatives put in place, the company is well-positioned to capture more of consumers’ mindshare. Besides all those strategic stuffs, they also improve operation with a new labor management system in place, installation of self-checkouts, and more efficient sequencing promotional tags.

The management plans to come back to their long-term growth track and expand the store base with at least 10% annual unit growth starting from 2024. Before the COVID, the company grew its store counts by ~12% annually. After the outbreak of COVID, they intentionally slowed the growth down, massively bought back shares and paid down debt, even though the management mentioned in their 2020 strategic plan to grow by 10%+ annually. This might disappoint some investors who always wish their holdings to grow faster and faster. For me, I would rather the company laid a solid foundation first. Now they already spent a few years consolidating their business, making attempts that have yielded positive results. So I believe this time they will soon be able to return to the rapid growth phase. Regarding their long-term growth plan, there are two aspects that I find especially commendable. On one hand, their expected growth rate is relatively conservative. The management estimates that the total costs of opening a smaller box store is $3.2M (~80% of it is buildout costs), including Capex, inventory, and pre-opening expenses. With the growth rate of store counts in the low teens, it is highly likely for them to expand relying solely on operating cash flows. Growing the business at a moderate clip, they will have more time to optimize new store locations and build a strong supply chain in unpenetrated markets. On the other hand, in the short-to-medium term, they will continue to prioritize increasing store density in markets where they’ve already achieved a certain level of concentration. I believe by this strategy they can capitalize on the existing/enlarged distribution centers and further deepen relationships with local farmers. From the development trajectories of many successful retailers (such as Uniqlo), it can be seen that when store density reaches a certain level, in-store sales often experience a significant boost due to the mere exposure effect. Currently, even in the penetrated areas like California or Texas, the market is far from saturated. Moreover, the market for products like organic foods will continue to evolve, with an increasing number of people becoming potential consumers for the company.

Competition: I would also briefly discuss the competitive position of Sprouts Farmers Market. Since its positioning is significantly different from the conventional retailers, I won’t make a comparison between them. As the CEO Jack Sinclair once stated: “we’ve said all along that we’re not going to try and win on conventional products with conventional grocers.” This prevents them from falling into the traps of commoditization of assortment. My focus is thus on competitions from similar retail concepts like Whole Foods (515 stores) and Trader Joe’s (564 stores). 1) Trader Joe’s has a truly unique assortment with most of its products in private brands. This is one of the main reasons why Trader Joe’s could drive the prices to such a low level. They offer fantastic deals especially in processed foods, snacks and alcoholic drinks. Those are not areas where Sprouts Farmers Market strives to provide much value. The quality of fruits and vegetables there doesn’t quite match those in Sprouts Farmers Market. As a result, my opinion, contrary to many others, is that Sprouts Farmers Market doesn’t face much direct competition from Trader Joe’s. Those who are worried because of Trader Joe’s might regard Sprouts Farmers Market as much of a commoditized business that has much overlapping, which in fact isn’t. What piqued my interests is that in many places, Sprouts Farmers Markets even cluster with Trader Joe’s, and this might bring traffic to both stores. 2) When it comes to Whole Foods, it generally sells at slightly higher prices. But it also has a wider selection than Sprouts Farmers Market. After my personal research, I still think it is up to personal preference when deciding where to go.

Competitive advantage

There are some good news and bad news for you, the readers in front of the screen, about Sprouts Farmers Market. Bad news 1: General foods industry is low-growth, commoditized, and boring (oh wait… isn’t this good news for some guys like Peter Lynch?). Good news 1: The market for something like organic or plant-based foods grows much faster. Bad news 1: There might be more competition around those concepts. Good news 2…

Good news 2 is that Sprouts Farmers Market is not a commoditized business as many might think. They have their competitive advantages. 1) They offer high-quality and fresh produce at prices generally below those of conventional food retailers and even further below high-end natural food retailers, thanks to the strong relationships with local farmers formed by decentralized buying structure, and the vertical control of the whole supply chain. This allows the company to purchase produce at a smaller quantity and participate in some kinds of opportunistic buying. The produce requires a high frequency of replenishment for consumers, which signifies more traffic to their other products (many of them are priced in line with their competitors). 2) By targeting “health enthusiast” and “selective shoppers”, they find their niche. They seek to avoid the fierce competition on conventional products with conventional grocers. Their relationships with niche vendors bring in some unique, quality products, which further deepens their moat. 3) They aspire to launch a great deal of innovative products for their private brands. Nowadays almost all retailers claim to invest in their private brands (just like they claim to cut costs and become omni-channel), but what differentiates Sprouts Farmers Market from more conventional food retailers is the structural competitive advantage and the successful track record of launching products. According to the management, they have nurtured and grown a lot of “once-shoestring” brands to category leaders, which is truly impressive. In 2022, Sprouts Farmers Market launched ~8400 new products. The private brands now account for 20%+ of the total sales, and still sees a long way to go.

In conclusion, I consider Sprouts Farmers Market’s niched positioning and differentiated assortment as their competitive advantages. The evolving assortment they offer is their moat, though it is the one that needs relentless excavation and continuous maintenance. One good question concerning the moat: is it easy to replicate the business or imitate what they already have with $5-10B (much more than the stock’s market cap) within a few years? My answer is no.

Financials

Debt level: The company only has very little long-term debt ($175M, due in 2027) now, and the interest coverage ratio (EBIT/interest expenses) is currently 50.22x, no need to worry about. The total capital leases are $1.322B. Even after including capital leases in the net debt, net debt/EBITDA is 1.71x. The company’s balance sheet is more solid than a majority of other retailers.

Return Ratios: The company’s ROIC has been in the low teens in the past several years. However, as the new format stores keep rolling out and attain maturity (it generally takes 4 years), I expect ROIC to be in the mid-teens five years out, because the new store format will reduce the lease expenses and buildout costs. What’s more, as they build stores around the existing distribution centers, the fixed costs will be spread out across more stores. The ROIIC (Return on Incremental Invested Capital) is far higher than the current ROIC. As for ROE, the company has achieved a 25%+ ROE in the past five years, mainly boosted by the leverage effect of the capital leases.

Inventory and comparable sales: Even though the company doesn’t experience severe inventory issues as many other retailers did over the last couple of years, the inventory did outgrow the revenues after COVID. The inventory turnover comes down a little bit, which is not a good sign. It is worthy of watching out for. The company has seen positive comp sales growth every quarter before 2021, the COVID anomaly. The normalized comp sales growth is 2%-3%, which is in line with the inflation.

Management

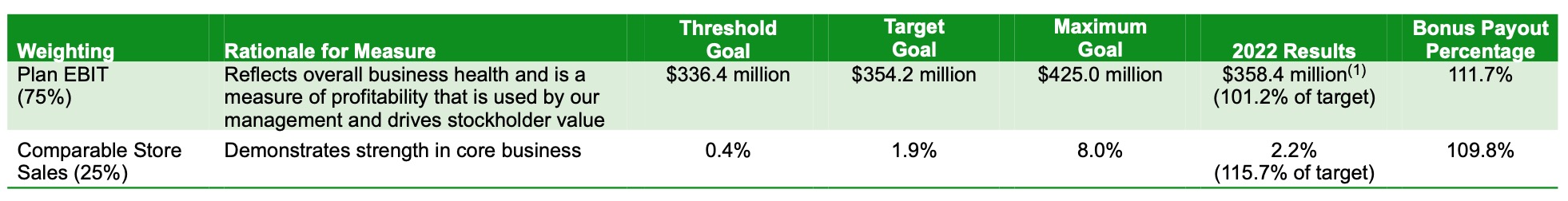

Incentive plan: The metrics for long-term incentive are EBIT (75%) and Comparable Store Sales (25%). It is good to see that the management didn’t take on more debt to expand the business more aggressively, thereby boosting the EBIT. Quite the opposite, they keep paying down debt.

Source: 2023 Proxy Statement

The long-term incentive compensation consists of 50% of performance shares with a three-year Plan EBIT target, 25% of RSUs (Restricted Stock Units) and 25% of the stock options. They didn’t include ROIC as a metric, even though they voluntarily provide ROIC as a business evaluation.

The management team has extensive experience in retail industry, including competitors like Walmart and Kroger. I don’t have my personal take on that, but my preference is that I want to see more internally promoted executives. For example, Dollar General’s new CEO Jeff Owen has been working at Dollar General for 30+ years, starting his career as a store manager trainee. But so far, the management has done a good job.

The current CEO Jack Sinclair has taken over the reins since 2019. Before that he served as the director of food section at Walmart. He struck me as conservative in terms of operating, and he also brought many good changes to the company over the past couple of years. Management is one of the most important things to consider when making investment decisions, but it is hard to evaluate as an outsider. Many times, what they decide not to do matter even more than what they do. In this case, I really like that they are not and will not going to try and win on conventional products with conventional grocers. This is what makes the difference.

Skin in the game: The executive officers and the directors don’t have a very significant ownership of the stock (1.2% of the shares outstanding). CEO Jack Sinclair hold 0.5M shares, which is a increasing stake due to stock compensations.

Source: 2023 Proxy Statement

Capital allocation

The beauty of investing in Sprouts Farmers Market is that there is still a long way to go, you don’t have to be worried about something like “diworsification” that once happened in many companies reaching mature stage. Their capital allocation strategy prioritizes maintenance and organic growth opportunities (the unit economics with cash-on-cash returns of 35%-40% per unit), and then buy back shares. After the outbreak of COVID, they opened new stores at a considerably slower clip, which means that they could use the remaining cash flows to pay down long-term debts and massively buy back shares. If they manage to return to the track of growing store counts by 10%+ annually, the Capex for expansion will increase. But wait! If opening a single store unit costs $3.2M, then the operating cash flows ($457.15M) alone can definitely support a store expansion of 10%-15% annually, with expenses for new distribution centers and supply chain included.

Acquisition: I don’t see any needs of doing massive acquisition. It is possible for them to acquire another farmers market and rebranded it to Sprouts stores.

Amateur’s edge (opt.)

In January 2023, I paid a visit to California and fortunately I went to a Sprouts Farmers Market store twice. I found there fairly well managed, with a clear and panoramic store layout. My friend is a health enthusiast, and he often goes to Whole Foods and Sprouts Farmers Market for shopping. I am personally not a health enthusiast like him, nor am I selective about shopping. But I do find that more and more people around care about some differentiating factors like organic, natural, and vegan. This is a good sign for Sprouts Farmers Market.

I also had a look at the interiors of the company headquarters via internet out of pure curiosity. The interior décor is far from luxurious, and many decorations are made of wooden panels. Nowadays tons of companies claim to cut cost, but I choose to trust in those who prioritize cost consciousness at the core, rather than those who claim to cut cost but enjoy private jets and new headquarters.

Source: Corporate Interior Systems

Valuation

It is not hard to come to the valuation of a company as such. After years of slowing down, the company is now well positioned to grow its store count by 10%-15% annually starting in 2024, and they are on the track. Although many investors hold the opinion that the net margin of ~4% (higher than the pre-COVID level) is not sustainable, and the gross and operating margin premium over other food retailers will narrow down, I disagree. I think that with an increasing penetration of private brands and the cost savings of the new store format, the net margin in the long term can be maintained at ≥4%.

Valuation: Assume that there is no margin expansion, which means that net margin stays at ~4%. Also assume that store count grows by 12%-13% annually, comp sales grow at 2% (historical average 2%-3%), and the management buyback 1%-2% of shares outstanding annually over the next couple of years. No dividend payment. Then we can arrive at an EPS growth of 15%-17% in the next five years. Currently the stock trades at a trailing PE ratio of 17.67x and a forward PE ratio of 15.46x. S&P 500 now trades at an average PE ratio of 23.46x. At such multiples, we have a PEG ratio of roughly 1x. If my assumptions are roughly right, the stock will bring shareholders an annualized return in the high teens 5-10 years out, without margin expansion and multiple expansion. If the reality unfolds better than expected, an annualized return of 20%+ is not impossible.

If the growth turns out to be more moderate, the management will have more cash to buy back more shares. In this case, I think the EPS growth will be at least 10%. For a high quality business that grows it EPS at a CAGR of 10%, the downside is limited unless there is some kind of mismanagement or unexpected disruptions.

Why this opportunity exists

- The disappointing stock performance in the past decade

- The growth rate slows down after the outbreak of COVID, which disappointed some growth investors

- The worries about the uncertainty in the retail industry

- The short interest of the stock is 20.51%

Risks

- KeHE Distributors is the primary supplier of dry grocery and frozen food products accounting for 40%+ of the total purchases, but in this partnership Sprouts Farmers Market does seem to have more bargaining power

- The current CFO Lawrence “Chip” Molley announced his retirement plan with no successor in place

Catalysts (opt.)

- The acceleration of store opening